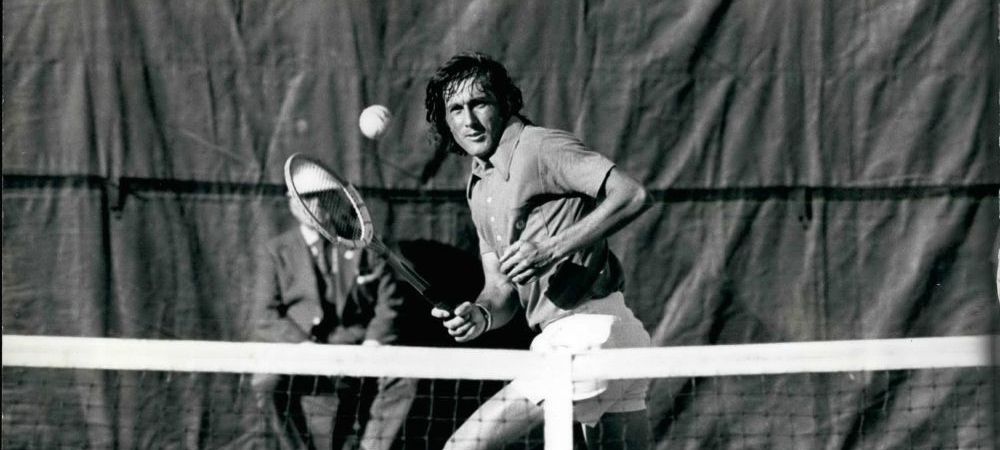

PerformanțeleRomânilor Povestea lui Ilie Năstase, campion la US Open 1972. Primul Grand Slam al României - Eurosport

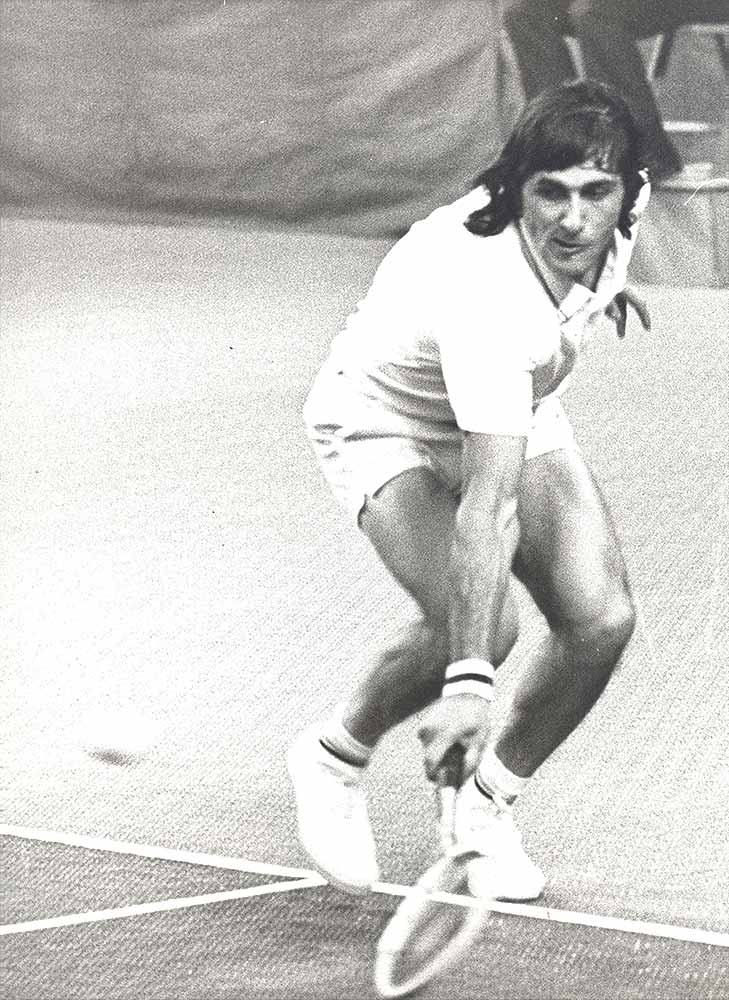

Romanian tennis player Ilie Nastase disputing a decision during a match at the Wimbledon Lawn Tennis Championships. | Tennis players, Ilie năstase, Play tennis

/origin-imgresizer.eurosport.com/2020/03/21/2796947-57722950-2560-1440.jpg)